As I have written earlier, my trading revolves around

Decision Points. I expect traders to act forcefully at these levels. Major

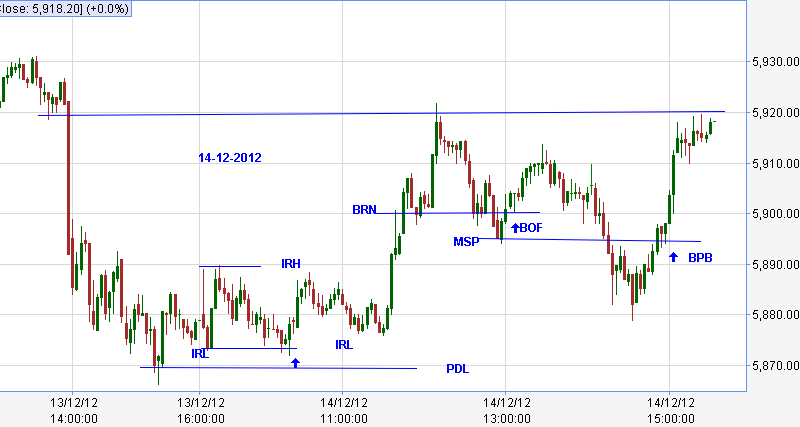

Swing Points ( MSP) are considered as decision points. MSP need some

explanation. There are two types of MSP.

Auction markets produce a continuous stream of data. As we

cannot process this raw data in real time, we chop it and chart it. We cut and

package the data as per our own convenience and comfort level (

Read)In fact

the data is same for all time frame traders. In my opinion there is no need to

look at a higher time frame chart as everything visible there, will appear much

more prominent in your trading time frame. The problem with lower time frame is

that if we start looking at lower time frame regularly, we will finally end up

trading it.

Trends and time frames create a lot of confusion among

traders. Most of this confusion can be avoided sticking to a single time frame.

Even a single time frame trend can be confusing. It may appear in different levels.

I will try to explain the important levels.

There are Micro, Minor and Major Trends in all time frames.

Micro trend is the lowest level trend. Successive candles

making higher highs and higher lows make a micro up trend. Lower lows and lower

high candles make a Micro down trend. Every candle Highs and Lows are pivots .These

are called Micro Pivots

Extreme points where the Micro Trend change happens are

Minor Pivots (A&B).Higher minor pivot highs and higher minor pivot lows

make a Minor up trend. Lower Minor pivot highs and lows make a minor down

trend.

Again extremes where a Minor Trend change happens are called

Major Pivots. (C&D).

Higher major pivot highs and higher major pivot lows make a

major up trend and the reverse a major down trend. These major pivots are

considered as MSP. These levels are very much visible in higher time frame

charts and will attract orders from higher time frame players.

Usually traders trade the Minor Trend of their trading time

frame. Trend traders try to ride the trend and remain in the trade till the

trend reverses. Most of the traders exit the trade when the swing pivot from

where the move leading to the extreme cracks. Notice the last picture. Crack of

pivot A is not considered as trend change. Crack of B is considered as trend change.

A swing pivot, the break of which is considered as trend change is also counted

as a MSP .MSP is the pivot low immediately preceding the highest high in an up trend and the pivot high immediately preceding the lowest low in down trend.Crack of MSP is considered as trend change

As usual do not think too technical and do not be too rigid

in your definitions. Now forget everything .Keep it simple. If a swing pivot looks prominent, treat it

as MSP and watch price action around this area.

“If it looks like a duck, quacks like a duck and walks like

a duck, it's a duck"