My trading revolves around trader decision points. I trade the acceptance and rejection of price at these areas and always trade away from the decision points.

Decision points are price levels where the market strongly reacted earlier. Most of the time they are proven price levels.But market will always create new DP levels Traders are creatures of habit and you can expect them to react at these price levels again

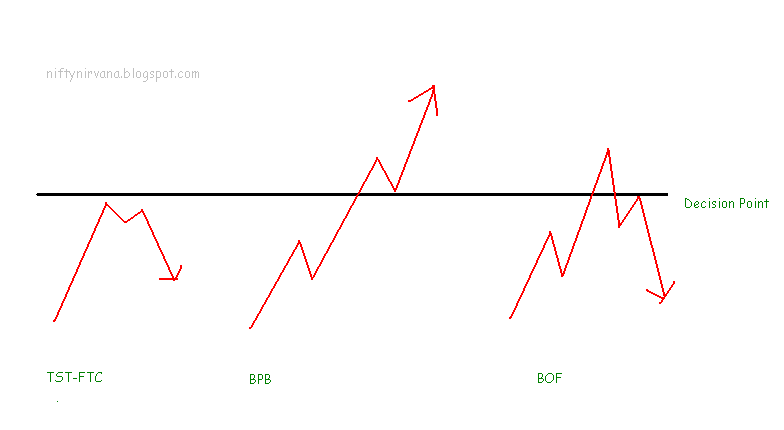

There are three trade setups when price encounters a decision point.

1.Price stalls just before the DP and there is no attempt to break the level. In other words it is failure to breakout. I call this TST and FTC (There is a slight difference between the two). After a TST and FTC price drifts down to the lower DP

2.Price breaks the level and pulls back. Pull back find support at the breakout level and the new level holds.

this is a signal to trade with the trend.If the level holds price can only do one thing that is to go to the next DP.This setup is called BPB

3.Price breaks above the DP but fail to hold the level.There is strong opposing order flow on the other side and price get rejected.. Naturally it has to come down to a lower DP where new buying emerges.This is called a BOF.

I have only given the long examples These can happen in short side also.There are other factors to be considered while trading these setups. like Strength of Trend,Strength of the DP. Price action at the DP , distance to the next DP level etc. I will try to explain these factors later.

These are the three setups you can trade with the lowest risk.