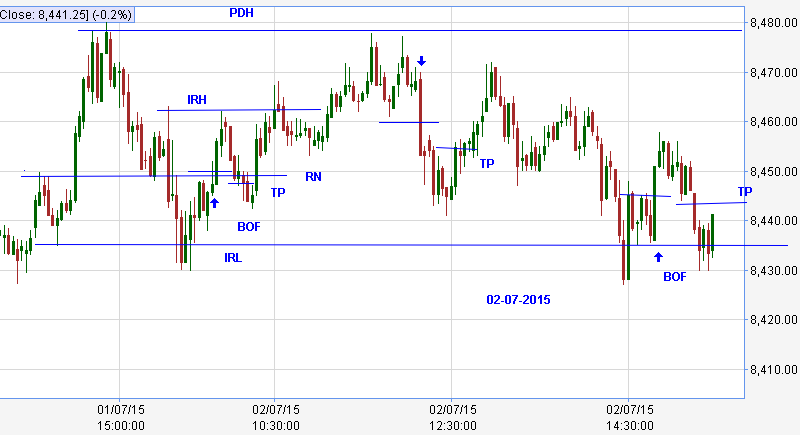

This is an illustrative example of the

concepts being discussed.Markings are just visualizations on historical

data in hindsight analysis

Nifty tried to move up above PDH/BRN and got rejected. But was not able to move below DO and IRL. Long on break of BRN. Stalled at NS BRN for a while and moved up. Exit around 8560. Type 1 trend day

Nifty tried to move up above PDH/BRN and got rejected. But was not able to move below DO and IRL. Long on break of BRN. Stalled at NS BRN for a while and moved up. Exit around 8560. Type 1 trend day