There is a substantial risk of loss associated with trading Derivatives . Losses can and will occur. My methods will not ensure profits

Friday, February 28, 2014

Wednesday, February 26, 2014

26022014

Nifty opened near PDC. First MC candle acted as IR. Avoided the break of IRH as PDH was very close.Nifty moved in a tight trading range for a long time. Went long on the BO of Cigarette. Trailed till the end through the channel . Very quite expiry day, Bull clearly dominated the day. No wonder ,it is Maha Shivratri tomorrow.

Tuesday, February 25, 2014

Monday, February 24, 2014

24022014

Nifty gaped down near RN 6150. IR Formed. Long on break of IRH. My target was PDH. But price went above PDH and traded in a range. TP inside the range. Another long on BO of tight range high. Target was BRN,but shaken out of trade before that. Tried a short trade on TST of BRN. Scratched on TRAP.Ended as a type 1 trend day.

Thursday, February 20, 2014

Wednesday, February 19, 2014

19022014

Nifty opened within previous day opening range and spent almost all the day there. Only signal was the BOF of range low. I was not trading the afternoon session. I had some other appointments.Just 123000 lot volume today. Volume is drying up day by day. Once it was trading around 6 Lakh contracts a day

Tuesday, February 18, 2014

18022014

Nifty opened within previous day range. Broke PDH/PDC/BRN.Went long on the BPB of BRN. TP when Nifty started to range. There was a BOF of range low. Skipped it as the range was very narrow. Shorted on the BOF of RN/HOD on break of the highest range low.This trade did not move. Scratched. There was a trap pattern to go long.This trade did not trigger.Missed the last BOF trade.

Monday, February 17, 2014

Saturday, February 15, 2014

Market Sense

Many traders relate trading to “Poker”. I have read it a thousand times since I started my market adventure. Still I do not know what this Poker is all about.

I always felt, trading is like driving a car. Everybody start learning it the same way. We learn rules and regulations familiarize with the controls and deliberately practice operating them. But knowing all these won’t make you a driver. To drive the car with confidence, you need something else. What it is?

It is called “Road Sense”. It is something that we acquire by experience. Level of road sense differentiates an excellent driver from an average one. I do not know how to define road sense. It is simply our ability to assess ourselves and others around leading to good judgments and driving habits.

Good judgment of the situation will help us to avoid trouble and accidents on the road. This involves understanding the behavior of other drivers, assessing our own strength and weaknesses, controlling situations and avoiding risks.

Trading is not different. Knowing all the patterns and trading tactics is not going to work unless you develop “Market Sense”. But it takes time and experience to develop. Unfortunately most of the people won’t stay that long. They will simply quit or flirt to some other method.

If you are really serious about your trading, select a method with a positive expectancy and stay long enough to develop this Market Sense. Your first priority should be the survival during this learning curve.

Anyway, start learning Poker and Golf. Traders are supposed to play these.!!!!!!!!

Friday, February 14, 2014

14022014

Nifty gaped up within previous day range. IR formed. Went short below IRL for a quick 10 point trade. TP at BRN. Thought of doing a TT at BRN. Level was so strong confluence of PDC/PDL/BRN. But did not do it. Went short on BOF of IRH. Scratched the trade when it bounced from MSP. Could not capture the down move. Double BOF of PDL gave a long signal. Nice trade of 50 points. TP at 6060 level.

Thursday, February 13, 2014

13022014

Nifty opened above BRN and sold. Broke BRN as well as PDL. Placed an order to sell at 6090. It did not trigger. So short below the MC as BPB of PDH. TP at RN 6050. I was expecting 6040 to hold and expected a bounce. I was looking to go long. But Nifty cracked the level and pulled back. Entered a short as a BPB TT. TP near BRN 6000. Nice trend day. Never broke the MSP

Wednesday, February 12, 2014

12022014

Nifty opened above PDH. Attempted to fall back into the range. Got rejected. Tried a new entry technique called "Touch Trades".(Please read 11022014 comments). TP when price failed to go above NS BRN. Went short below MSP. TP at BRN. Long on the DB,LOL,BOF of BRN/PDH. There was only very little space. But I expected it to hit the Flip. Thought of doing another Touch Trade at the flip. But was not very confident watching the lower tails of candles. Did not attempt the next BOF.

Tuesday, February 11, 2014

11022014

Nifty opened within previous day range. IR formed. Short below IRL. Price refused to go below previous day range.Scratched the trade.Shorted on BOF of PDH below day open. This trade also did not move as expected.Covered at range low Rest of the day it chopped within the range. No other trades.Volumes have dried up. 127000 lots today as well as yesterday.

Monday, February 10, 2014

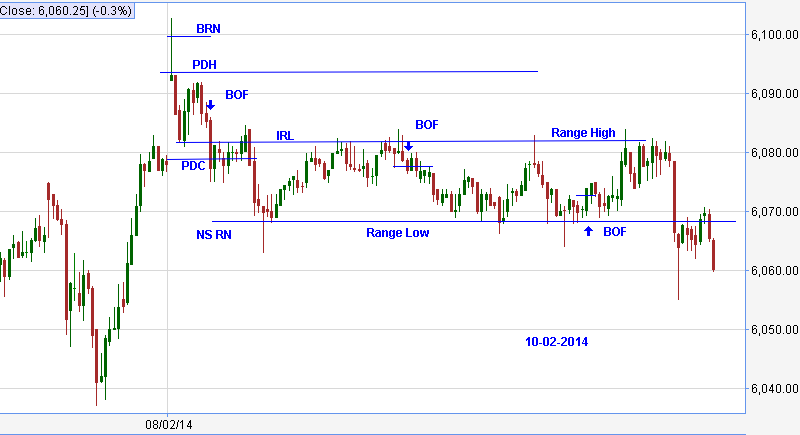

10022014

Nifty opened near PDH.BOF of PDH/BRN gave a short signal. Hesitated to short below the pin bar. IR formed. Shorted on break of PDC. Thought it will move through the fluid. But RN of NS gave support. Covered shorts above the pin bar high. Attempted two BOF trades at range high and range low of 10 point range expecting the break of other extreme. Both trades scratched. Missed the last fall.

Friday, February 7, 2014

07022014

Nifty opened above PDH. IR formed. Missed the TST trade at IRH as I did not expect the sudden fall.Went short on BOF of PDH. It made 20 points. Could not trade the last up move as there were too many levels above it. Notice the pull back after the first break of PDH to the range low as explained in the post "Initial Stops" Pic9.

Thursday, February 6, 2014

06022014

Nifty opened above PDH. First candle acted as a MC. Went long above it ignoring the RN of NS. Main reason was that I felt very bullish after looking at the daily chart.I wont do it in future. Another reason was good defense.Stop beyond IRH,DO,RN levels was another plus point.Then my screen got stuck and had to restart.I missed the down move.Luckily my stop at 6049 triggered.Tried a long on BO of range high as PP. This trade gave just 10 points.No other trades today.Ended up with a loss on a 160 point move day.Market retraced the entire fluid area

Wednesday, February 5, 2014

05022014

Nifty gaped down. Fall stalled at BRN. IR formed. Went short on BPB. It was not a good decision. Nifty was already down nearly 50 points and further move was very low probability. Scratched immediately at breakeven. Went long on break of MSP as BPB of BRN. TP around 6035 on break of consolidation. Did not take any other trade as nifty started channeling.

Tuesday, February 4, 2014

Monday, February 3, 2014

Saturday, February 1, 2014

Failure to Continue

There is too much of confusion among the readers about FTC (Failure to Continue). I will try to explain it further. FTC is not really a pattern in the true sense. We are basically trading three patterns at Decision Points namely TST, BOF and BPB. FTC can either be a TST or BOF but never a BPB. Further it can be a failure to test a new price extreme.

There are two types of Decision Points. Fixed levels and

Dynamic levels. Fixed ones are levels like PDC,PDH,PDL,DO,BRN etc. These levels

will not change. Dynamic levels are levels created by the market during the

current session. Market will be creating new DPs and discarding the old ones all

the time. Examples are HOD,LOD, MSP and range extremes.

Usually we trade established levels where market reacted

earlier. Sometimes market will establish a fresh extreme and change direction

from there either to change trend or to establish a new range. FTC is an effort

to capture such trades. FTC trades are always counter trend trades and hence

relatively high risk trades. Basically we are trying to identify trader exhaustion

either on the long side or on the short side.

Look at Pic 1. Price is in a momentum move. It breaks a DP

and moves up further to stall at a certain level. We feel that buyers are

exhausted and market may consolidate. We look for FTC here. We keenly observe

what price is doing. FTC can occur in 3 ways explained as A,B and C. These are failure

to test the extreme, BOF of extreme and TST of the extreme. Price may reverse

or consolidate. Most probably we can expect a range here. Lower boundary of the

range can be the DP, Flip or MSP.

FTC is very useful in managing the trades. Look at Pic 2.We

enter on the BOF of a range low at A. Price moves up breaking the range high

and stalls at a certain point called B.. An FTC at point B is a signal to book

our profits. Here price may consolidate for a long period in a new range. It is

better to capture most of the move by exiting at B on FTC and wait for the next signal to act.

I have given only the long example. It is applicable on

short side also.Be very careful while initiating new trades at FTC. Ensure that there is clear exhaustion of momentum price move.If you are in doubt, better to stay out. Hope it is clear. Otherwise let me know.

Subscribe to:

Comments (Atom)