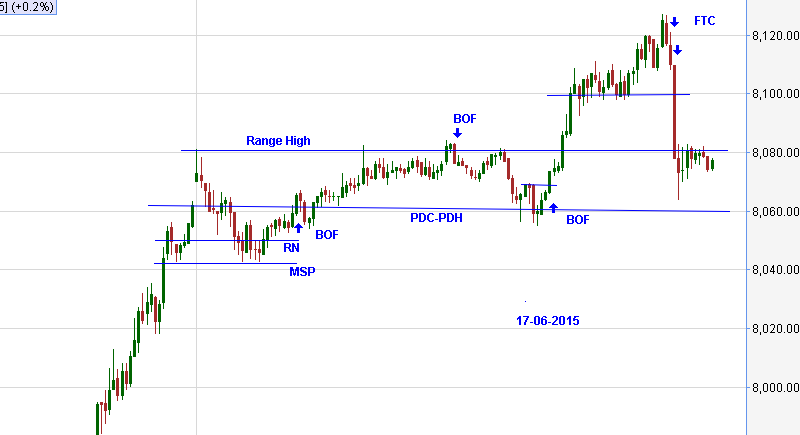

This is an illustrative example of the concepts being discussed.Markings are just visualizations on historical data in hindsight analysis

Could not trade today.After yesterdays vertical move some pull back was due. Price pulled back to MSP breaking PDC/PDH and RN. Even if somebody shorted break of PDH, market gave opportunity to get out. There was a long signal on BOF of PDC/PDH.Trade went to its target Range high. BOF of range high also hit the target PDC. But after a deep pull back. Long at PDH gave a nice move to 8120. There was another opportunity short on FTC, below MSP and below BRN

Thanks So much ST..

ReplyDeleteST,

ReplyDeleteI have few querries.

1. In the first trade you shown. we were in the Middle of range . why would one take it. with not so Strong set up?

2.Can we consider 11.21 to 12.15 as pp and take long above 11.18 for pressure play or range brekout as we were consolidating near days high. . why would u avoid it.

3.PDC -PDH level was criss crossed two -three times where u shown the long trade. why would we take the same in middle of the range. with such non important level.

Regards

Bharat

Trade is a low probability one and a delayed one. Price can trade in 8040-8080 Probable range and price turns bearish only after it breaks below 8040. If you wait till then risk will be 20 points. Right entry is near 8040. But with PDC/RN/PDH above it ,not advisable. Only + was 20 point space and two levels PDH-RN that can lend support

DeleteThere is no way to know when price is ripe for a PP trade. Usually I look for some clues that shows price is not interested to go the other way like TRAP or the BOF of other extreme.Critical mass also should favor a PP trade

Price will overshoot levels a little bit here and there. Market is a place where a million people execute a million different strategies. I dont think price criss crossed the levels. Price came below the levels and got rejected once.

8040-80 is a probable range. Expectation was a move till range low.That is why a TST was not attempted there. Price got rejected from below PDH. Then attempted a push again which failed to extend beyond early low. Then we need to change the expectation as per the new information.

ST

Thanks a Lot ST:)

DeleteST

ReplyDeletenice movement today went long on BOF of RN exactly @8050 because SL was near and a bit bullish day but at BOF of range high trailing SL of 8070 was hit and 2nd BOF i could not catch the big upmove.Was it a good trade?

When you entered PDH/PDC/RN/NS RN were all above it. Trend asserted and bailed you out

DeletePay attention to space, always

ST

Thanks a lot ST. In the last trade if we take a short below BRN where should SL be?

ReplyDeleteFor the last upmove where was MSP, congestion low or the pivot above it?

MSP was 8110 Flip. You keep SL at 8110 or above the BO bar

DeleteIf price pull backs and make a new swing high , shift SL to that point

ST

Hi ST,

DeleteThanks for the many lessons today.

Sir,

ReplyDeletehttp://yourtradingcoach.com/trading-process-and-strategy/real-opportunity-is-found-at-the-edges-of-market-structure/

Hardly I find you entering at edges, your entries are usually after a confirmation pivot break.

Just wanted to hear from you about this type of entering at edge.

Entering at the structural edges without confirmation requires a lot of experience and confidence, Which I do not have.

DeleteI am attempting some TST entries selectively as an experiment

ST

Hi ST,

DeleteDoesn't entering at structural edges also mean many failed trades, though the successful ones may make up for the failed ones? I think Lance takes around 10 or 12 trades a day, we limit to 4 .

Attempt structural trades in the direction of trend and go CT on clear exhaustion not expecting a big move

DeleteLance basically scalps and this is not practical in our expensive markets. Here 12 points a day can cost 40 points in commission and slippage alone. Only capturing whole swings in 3M charts work here

ST

How about long @ 1003 ?? this was swing low which was holding also the big bear of 954 hr also stalled which meant sellers were failing to push lower, 2 candles held high of 8050, break above was good long also as buyers would be looking to enter around this zone.

ReplyDeleteI do not have confidence to trade into such cluster of barriers

DeleteST

Hi ST, please post today's chart if possible. The.day feels somehow incomplete without your chart.

ReplyDelete