Thursday, August 28, 2014

Wednesday, August 27, 2014

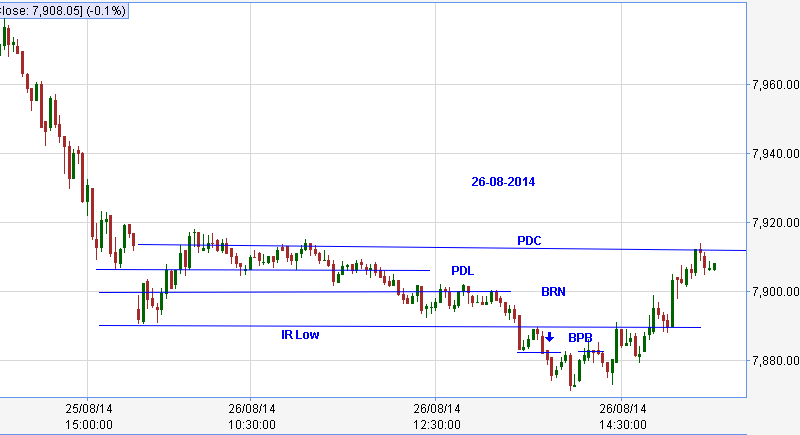

Tuesday, August 26, 2014

Monday, August 25, 2014

Friday, August 22, 2014

Thursday, August 21, 2014

Wednesday, August 20, 2014

Tuesday, August 19, 2014

Monday, August 18, 2014

18082014

Nifty opened below PDC. went up breaking PDC/BRN and PDH. Long on BPB of PDH. Stopped out when price bounced from all time high. It was a TRAP pattern, a BOF of MSP. Did not enter til price moved above the all time high. Went long on BPB of RN as I expected the bullishness to continue and there was no overhead resistance TP at 7875. Type one trend day.

Thursday, August 14, 2014

Wednesday, August 13, 2014

13082014

Nifty opened below PDC/RN. Unexpectedly broke above PDH. There was no follow up buying and went short below RN 7750. trade refused to move beyond IRL. Covered at a small profit. Another short on the second BOF of PDH. It broke IRL and stalled at NS BRN. Covered when second push failed. Tried another PP trade long . This trade also did not move as expected. Bounced from PDH/PDC area

Tuesday, August 12, 2014

12082014

Nifty gaped up and traded in a 20 point range for a long time. Went long on BOF of range low. Exited the trade when price failed to stay above the range and broke the BO candle low. Price refused to come down and broke the range high again. Long on BPB of range high. Ignored BRN as waiting for its break will increase risk. TP near RN at the end of the fluid

Monday, August 11, 2014

11082014

Nifty gaped up 50 points . Bias was positive. Still tried a short below IR as price failed to continue above the opening bar. Scratched when price bounced from NS BRN area. Rest of the day Nifty traded within this 20 point range. Did not attempt the last BOF trade of LOD as it came very late and it was the best opportunity of the day

Saturday, August 9, 2014

Taming the Trend

To trade the markets successfully, we need to define a

structure for the market and also need to align with the trend. Unfortunately

there is no way to correctly define the structure and the trend. All the

technical analysis is an attempt to do this.

My approach is based on two assumptions.

- There are two kinds of players in the market. Day Traders and “Other Traders”. Day traders trade intra day moves and never hold overnight position. Other Traders are willing to hold their positions and not interested in small moves like Day Traders

- All the traders basically attempt to buy low and sell high in the market. Day traders play with smaller time frame charts and others go with Daily Charts.

I will try to explain it with the help of a picture. 1,2 and

3 are Daily candles making lower highs and lower lows. Daily chart is in micro

down trend. Today, on the fourth day game will be played within candle 3 which

may act as a range. I have shown the enlarged view

Break above PDH will be a major transition as daily will

change to rally mode. Our expectations are a ranging action inside the previous

day candle or a breakdown below PDL if selling continues. We assume “Other”

traders will sell in force near the top of this range.

Look at example “A”. As range traders we try to buy the lows

and sell the highs. As price is trading in a higher range, we prefer to buy the

lows to go with the trend. Expect opposite order flow from “Other” traders as

we approach the PDH. Do not expect these trades to run. Once price breaks down

from the higher range to a lower one we try to sell the highs. Here both the

groups are selling. Let our

profit run.

These are all some guide lines. Do not make it a rule.

Sometimes even if our trade is well aligned with the trends the trade may not be

a winner. Look at situation B. Price gaps below PDL.Day Traders stay with the

trend and short the range low. BO fails and reverses back above PDL Trapped day

traders order flow will trigger a momentum up move giving great opportunity to

the “Other” traders to sell into. This will trigger another down move trapping

longs this time.

Market is never going to give us a static edge. Knowing well

what is going on and changing the tactics as per the situation makes one a

winner. There is no substitute for screen time experience.

Friday, August 8, 2014

Thursday, August 7, 2014

07082014

Nifty opened near PDL. Got rejected. Avoided long as PDC and BRN was close. Short on BOF of PDC/BRN. Target was LOD. Price broke PDL and consolidated below it. Exited the trade. Long on PP when price came back to the old range. TP near 7730. Missed the down move as I expected some consolidation and attended some other work.There was a BOF of LOD . Did not go for it

Wednesday, August 6, 2014

Tuesday, August 5, 2014

05082014

Announcement day . Nifty traded within the previous day closing range. There was some chop during announcement. Skipped this BOF of BRN and range low. Waited for the market to stabilize. Went short on the BOF of PDH. Nice down move. Exited when price moved above the pull back high. Nifty stalled below the range flip for a long time and gave a nice PP long trade above BRN. TP around 7775. Done for the day. Traded on battery back up . No power since morning.

Monday, August 4, 2014

04082014

Nifty opened within previous day closing range. IR formed went long above IRH as three attempts to fall below IRL failed. Nifty stalled near BRN and drifted down. Exited at a small profit. Tried a short below IRH as BPB. Trade failed stopped out above the pull back swing high. Long on BOF of IRH. Trailed and stopped out below BRN. Could not capture the last leg up.

Sunday, August 3, 2014

Gift from Dilipbhai

Here is another great gift from our beloved Dilipbhai. He has chosen the right occasion. First Sunday of August being the Friendship Day. I am sure all the friends of Nifty Nirvana will find it useful, will love it and cherish. He has compiled all the postings under "Rants n Raves" into a well formatted E-Book with great effort.

Dear Dilipbhai, Thank you very much for your contribution.God bless you.

You can download the book clicking the link. Kindly give your valuable feed backs. Please do not forget to thank our beloved Dilipbhai and please do share this through your social networks.Thank you all

Friday, August 1, 2014

Practice Patience

Recently I checked a live discussion of the method just to

know how well it worked. It was during market open. To be frank many people are not

approaching trading the right way. They bring in their day job culture to the

trading desk.

In our day job we are

supposed to start doing work immediately after switching on the system.

Just idling and watching is not considered as work. Traders are so impatient and

need to trade desperately on market open itself. They jump on to a mediocre trade and lose. Then

hesitate to take the next best opportunity. Fear of missing out sets in and they impatiently enters another trade and get stopped out. This cycle goes on.

Further everybody wants their trade to play out immediately.

They have no patience to sit tight and trail. Every small adverse move drains

their patience and the trade is exited well before extracting its potential.

I do get a lot of mails from many new traders. One question is often repeated and they want to know how long it will take to become profitable. Frankly, I don’t know. It may take a few weeks, months or years. But people are so impatient that they start to complain after a week of live trading. Many of them might have shifted to some other method losing their patience, I am sure.

I do get a lot of mails from many new traders. One question is often repeated and they want to know how long it will take to become profitable. Frankly, I don’t know. It may take a few weeks, months or years. But people are so impatient that they start to complain after a week of live trading. Many of them might have shifted to some other method losing their patience, I am sure.

Impatience has become the basic character of the generation.

We need everything to be instant like Instant messaging, instant information, and

of course instant food. We want everything and we want it now. We have no time

to learn the method. We have no time to wait for good setups and we have no time

to wait for the trade to play out. Please do understand that this impatience is

a derivative of fear and greed, the cardinal sins of trading.

“One moment of

patience may ward off great disaster. One

moment of impatience may ruin a whole life” — Chinese

Proverb

01082014

Traded the August chart. Nifty gaped down below PDL. IR formed. Did not trade the area between BRN 7700 and PDL 7750 as this area was PDC and PDL in continuous charts. Nifty sold touching PDL. Went short below IRL. After a scary pull back it was smooth ride till NS BRN level.

U R Dave has posted his trade journal for the month of July.Great going URD. Congrats ( Read )