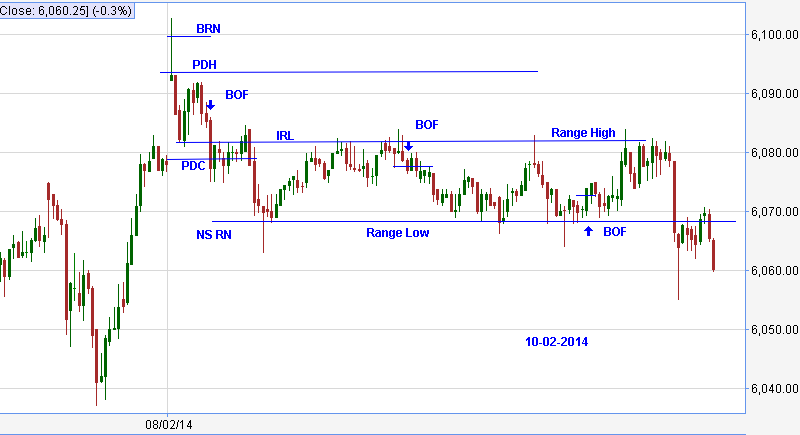

Nifty opened near PDH.BOF of PDH/BRN gave a short signal. Hesitated to short below the pin bar. IR formed. Shorted on break of PDC. Thought it will move through the fluid. But RN of NS gave support. Covered shorts above the pin bar high. Attempted two BOF trades at range high and range low of 10 point range expecting the break of other extreme. Both trades scratched. Missed the last fall.

ST,

ReplyDeleteThe two BOF trades that you took ended in a scratch. However, both of these trades travelled upto the opposite range boundary. So why and where did you decide to scratch. In general, how do you decide when to scratch. Take for e.g your first trade. You scratched it at pin bar high. Agreed that there was a RN for NS, but above the pin bar high we had a LOL resistance and I would have kept my SL at least above IRL.

PATrader

ReplyDeleteGenerally I scratch when price breaks my entry point flip or FTC at an area.

For the first trade the original stop was above the BO candle high which never broke.One could have stayed in the trade till day end.

I closed the trade above the pin bar high due to two reasons.

1.Markets rarely impulse more than thrice without a consolidation. Here the third impulse terminated at NS RN and I expected a consolidation.

2.I have a very strong tendency to book first trade profits early.I feel very comfortable rest of the day with it. I need to correct this as I have exited many good trades prematurely.

ST

ST,

ReplyDeleteIs longs above 12.57 valid on brkout failure of range low ?

What is the difference between that and entry on 13.54 ?

Bharat

Hi,

ReplyDeleteBOF idea is good, but it would be better If we enter trade with any Pin bar or Engulfing bar.

Dear ST

ReplyDeleteI have a strong fear of loosing which is causing me to not to trade (I am trading with very low amount in cash market) somehow mentally i am unable to overcome this fear of loosing, can you suggest something?

Reddy

ReplyDeleteCandles are not that important. The question is whether price is getting rejected or accepted in the new area. A pin bar in 3M charts is not a pin bar in 5M charts.Watch the video

http://www.youtube.com/watch?v=enPN5pIeGMo#t=221

ST

Sir good evening .Markets rarely impulse more than thrice without a consolidation sir i am unable to understand this ,kindly update thnx

ReplyDeleteBharath

ReplyDeleteIt is a valid BOF and price went where it was supposed to go.

We are trying to trade a 10 point and these trades are CT trades. 13.54 BO rejection was fast and BO was a little more deep.

ST

Amber

ReplyDeleteA trend move consists of impulse waves and counter trend pull backs. An impulse is followed by a pull back. You rarely get three impulses in a row without a sideways range move.

ST

Umang jain

ReplyDeleteEverybody will have some fear. It is natural. Trade small with a capital you can afford to lose risking just 0.25% in the beginning

ST

Sir thnx

ReplyDelete"Markets rarely impulse more than thrice without a consolidation" ...thats experience speaking.

ReplyDeleteST, why did u not take 1:27 pin bar short i.e. BOF of range high?

Also, where could one have entered to capture the last fall, I was in the market but didn't find a suitable entry.

Anon

ReplyDeleteI did not take 1.27 BOF.

Price did not move above previous BOF high

There was no formation. I have taken the other two BOF entries on break of minor pivot points.

If you want to capture last fall blindly sell at range high resistance and keep a SL a few points above it.A lot of traders do that.

It is very difficult to trade these 10 point ranges. Better option is to stay out.

ST

Sir,

ReplyDeletePlz go through with url and clear my doubt if time permit..ur advice carry lot of weight so plz sir clarify it..http://screencast.com/t/CQUVxUql

Thank u..

sir,

ReplyDeleteEarlier i short that Rcap on 325 and cover it on 320.10...here i'm talking abt second entry...thank u..

Sentu

ReplyDeleteSorry.

I do not trade Rcap.

Do not track wedges or classic patterns

ST

sir,

ReplyDeleteactially i'm talking abt in general entry position on that scenario..if possible plz go through it...thank u..

Sentu

ReplyDeleteThere is no trade in your charts as per my method.Looks like a TST of PDL

ST